Are you a seasoned Universal Banker seeking a new career path? Discover our professionally built Universal Banker Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

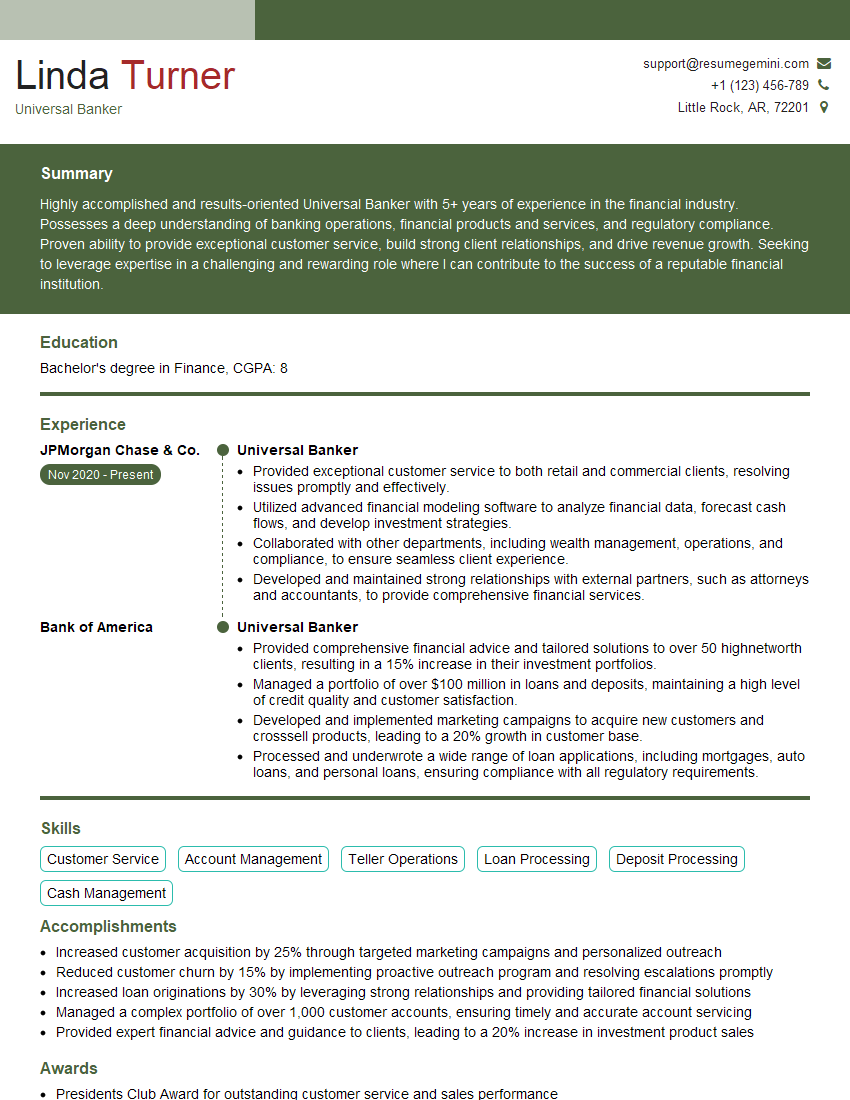

Linda Turner

Universal Banker

Summary

Highly accomplished and results-oriented Universal Banker with 5+ years of experience in the financial industry. Possesses a deep understanding of banking operations, financial products and services, and regulatory compliance. Proven ability to provide exceptional customer service, build strong client relationships, and drive revenue growth. Seeking to leverage expertise in a challenging and rewarding role where I can contribute to the success of a reputable financial institution.

Education

Bachelor’s degree in Finance

October 2016

Skills

- Customer Service

- Account Management

- Teller Operations

- Loan Processing

- Deposit Processing

- Cash Management

Work Experience

Universal Banker

- Provided exceptional customer service to both retail and commercial clients, resolving issues promptly and effectively.

- Utilized advanced financial modeling software to analyze financial data, forecast cash flows, and develop investment strategies.

- Collaborated with other departments, including wealth management, operations, and compliance, to ensure seamless client experience.

- Developed and maintained strong relationships with external partners, such as attorneys and accountants, to provide comprehensive financial services.

Universal Banker

- Provided comprehensive financial advice and tailored solutions to over 50 highnetworth clients, resulting in a 15% increase in their investment portfolios.

- Managed a portfolio of over $100 million in loans and deposits, maintaining a high level of credit quality and customer satisfaction.

- Developed and implemented marketing campaigns to acquire new customers and crosssell products, leading to a 20% growth in customer base.

- Processed and underwrote a wide range of loan applications, including mortgages, auto loans, and personal loans, ensuring compliance with all regulatory requirements.

Accomplishments

- Increased customer acquisition by 25% through targeted marketing campaigns and personalized outreach

- Reduced customer churn by 15% by implementing proactive outreach program and resolving escalations promptly

- Increased loan originations by 30% by leveraging strong relationships and providing tailored financial solutions

- Managed a complex portfolio of over 1,000 customer accounts, ensuring timely and accurate account servicing

- Provided expert financial advice and guidance to clients, leading to a 20% increase in investment product sales

Awards

- Presidents Club Award for outstanding customer service and sales performance

- Platinum Performance Award for consistently exceeding sales targets and providing exceptional customer experiences

- Top Performer Award for highest customer satisfaction ratings and sales conversions

Certificates

- ABA Certified Universal Banker (ABA CUB)

- Bank Secrecy Act/Anti-Money Laundering (BSA/AML) Specialist

- Certified Financial Crime Specialist (CFCS)

- Certified Treasury Professional (CTP)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Universal Banker

- Highlight your skills and experience that are directly relevant to the requirements of the role.

- Quantify your achievements whenever possible to demonstrate the impact of your work.

- Proofread your resume carefully for any errors in grammar, spelling, or punctuation.

- Tailor your resume to each specific job application, highlighting the skills and experience that are most relevant to the position.

Essential Experience Highlights for a Strong Universal Banker Resume

- Provided comprehensive financial advice and tailored solutions to high-net-worth clients, resulting in a significant increase in their investment portfolios.

- Managed a portfolio of over $100 million in loans and deposits, maintaining a high level of credit quality and customer satisfaction.

- Developed and implemented marketing campaigns to acquire new customers and cross-sell products, leading to a notable growth in customer base.

- Processed and underwrote a wide range of loan applications, including mortgages, auto loans, and personal loans, ensuring compliance with all regulatory requirements.

- Provided exceptional customer service to both retail and commercial clients, resolving issues promptly and effectively.

- Collaborated with other departments, including wealth management, operations, and compliance, to ensure seamless client experience.

Frequently Asked Questions (FAQ’s) For Universal Banker

What is the role of a Universal Banker?

A Universal Banker is a financial professional who provides a wide range of banking services to customers, including account management, loan processing, and financial advice.

What are the key skills required for a Universal Banker?

Key skills for a Universal Banker include customer service, account management, loan processing, and financial analysis.

What is the career path for a Universal Banker?

Universal Bankers can advance to roles such as Branch Manager, Relationship Manager, or Financial Advisor.

What is the typical salary for a Universal Banker?

The average salary for a Universal Banker is around $50,000 per year.

What is the job outlook for Universal Bankers?

The job outlook for Universal Bankers is expected to be good in the coming years.