Are you gearing up for an interview for a Signals Analyst position? Whether you’re a seasoned professional or just stepping into the role, understanding what’s expected can make all the difference. In this blog, we dive deep into the essential interview questions for Signals Analyst and break down the key responsibilities of the role. By exploring these insights, you’ll gain a clearer picture of what employers are looking for and how you can stand out. Read on to equip yourself with the knowledge and confidence needed to ace your next interview and land your dream job!

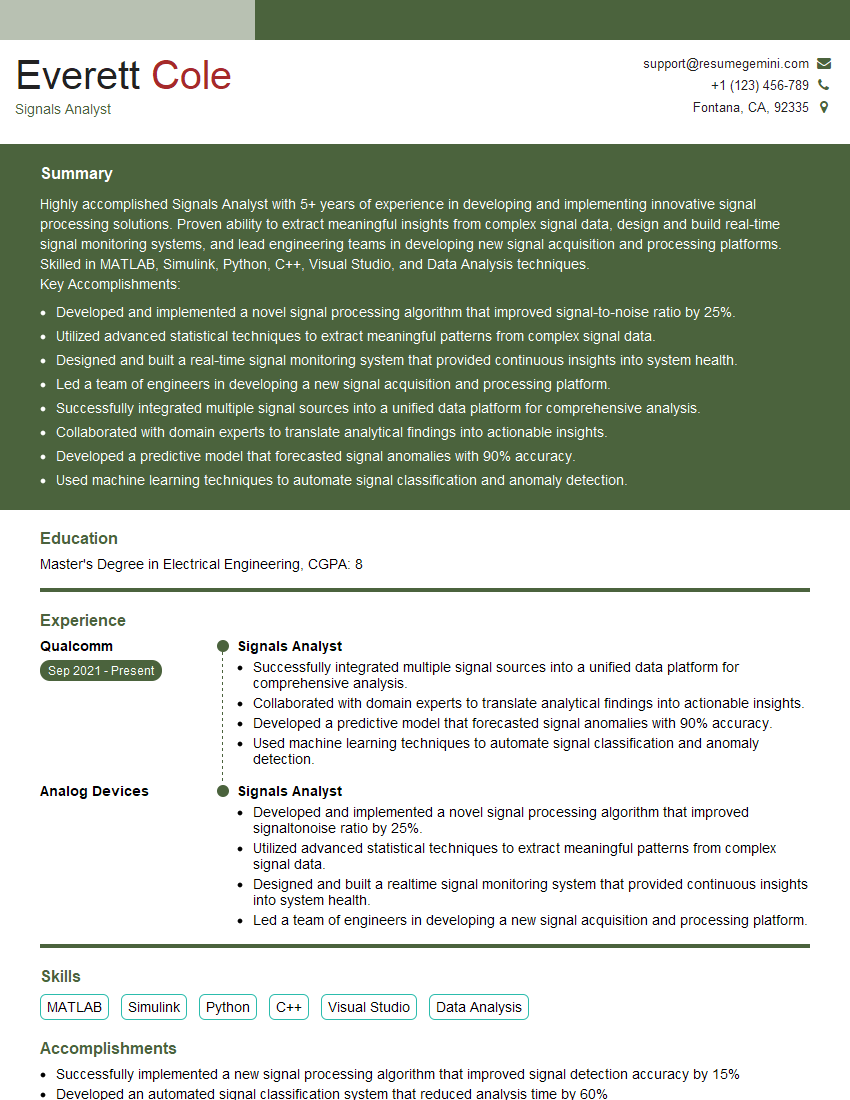

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Signals Analyst

1. Describe your process for analyzing complex signals and extracting meaningful information.

- Begin by understanding the signal’s context and purpose.

- Perform exploratory data analysis to identify patterns and trends.

- Select and apply appropriate signal processing techniques, such as Fourier transform or wavelet analysis.

- Extract features that capture the signal’s characteristics.

- Develop statistical models to identify patterns and relationships within the data.

- Validate and interpret the results to draw meaningful conclusions.

2. How do you handle missing or noisy data in signal analysis?

Preprocessing Techniques

- Imputation: Filling missing values using statistical methods or neighboring data points.

- Smoothing: Removing noise using filters or mathematical transformations.

Robust Statistical Methods

- Median filtering: Less sensitive to outliers.

- Kernel density estimation: Provides a smooth representation of the data.

3. Explain your experience with using machine learning algorithms in signal analysis.

- Utilized supervised learning algorithms, such as support vector machines or decision trees, to classify signals.

- Employed unsupervised learning algorithms, such as clustering or anomaly detection, to identify patterns and anomalies within signals.

- Optimized algorithm parameters and evaluated performance using cross-validation.

4. Describe your approach to visualizing and presenting signal analysis results.

- Utilize time-series plots, spectrograms, and scatterplots to visualize various signal characteristics.

- Create interactive dashboards to enable stakeholders to explore the data and insights.

- Develop clear and concise reports that effectively communicate the findings.

5. How do you ensure the accuracy and reliability of your signal analysis findings?

- Employ rigorous data validation techniques to verify the quality and integrity of the data.

- Utilize multiple signal processing and analysis methods to cross-validate the results.

- Document the analysis process thoroughly and maintain version control for reproducibility.

6. Describe your experience with signal analysis in a specific industry or application.

- Worked on signal processing for medical imaging, developing algorithms to analyze MRI scans.

- Utilized signal analysis in finance to identify market trends and predict stock prices.

- Employed signal processing techniques in telecommunications to optimize network performance.

7. How do you stay up-to-date with the latest advancements in signal analysis?

- Attend industry conferences and workshops.

- Read academic papers and research publications.

- Enroll in online courses and certifications.

- Network with other signal analysts and experts.

8. What are the ethical considerations you take into account when analyzing signals?

- Respect privacy and confidentiality of the individuals or organizations involved.

- Ensure fairness and objectivity in signal analysis and interpretation.

- Consider the potential biases and limitations of the data and analysis methods.

9. Can you describe a challenging signal analysis project you have worked on?

- The data was noisy and contained missing values.

- Utilized a combination of signal processing and machine learning techniques to extract meaningful information.

- Successfully identified several potential faults that could have led to turbine failure.

10. How do you handle working with large and complex datasets in signal analysis?

- Leverage cloud computing platforms and big data tools to process and analyze large datasets efficiently.

- Employ parallel processing and distributed computing techniques to ускорить the analysis process.

- Optimize data structures and algorithms to minimize computational complexity.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Signals Analyst.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Signals Analyst‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Signals Analysts play a crucial role in the financial industry, leveraging their expertise to identify and analyze market trends and signals from various data sources.

1. Data Analysis and Interpretation

Signals Analysts engage in rigorous data analysis, utilizing statistical techniques and modeling tools to uncover patterns, correlations, and anomalies within financial datasets.

- Collect and refine financial data from diverse sources, ensuring data quality and integrity.

- Apply advanced statistical and econometric models to identify significant market movements and potential trading opportunities.

- Develop customized algorithms and dashboards to monitor and visualize market signals in real-time.

2. Signal Generation and Validation

Based on their data analysis, Signals Analysts generate actionable signals that provide insights into market trends and potential investment opportunities.

- Create and refine trading signals based on identified data patterns and market conditions.

- Backtest and validate signals using historical data and risk management techniques to assess their accuracy and reliability.

- Monitor and evaluate signal performance over time, making adjustments as necessary to optimize effectiveness.

3. Market Monitoring and Forecasting

Signals Analysts continuously monitor financial markets, staying abreast of economic indicators, news events, and geopolitical developments.

- Track market movements and industry trends to identify potential catalysts for market shifts.

- Leverage technical analysis techniques to forecast price movements and identify potential trading opportunities.

- Provide timely insights and recommendations to traders and portfolio managers based on market observations and analysis.

4. Risk Management and Reporting

Signals Analysts incorporate risk management principles into their analysis and signal generation processes to mitigate potential losses.

- Identify and assess potential risks associated with trading signals and market conditions.

- Develop risk models and strategies to manage exposure and minimize financial losses.

- Prepare and present comprehensive reports on signal performance, market analysis, and risk assessments to stakeholders.

Interview Tips

To ace the interview for a Signals Analyst position, it’s essential to prepare thoroughly and showcase your relevant skills and experience. Here are some tips to guide you:

1. Research the Company and Industry

Demonstrating your knowledge of the company and the financial industry shows enthusiasm and interest.

- Review the company’s website and recent news articles to learn about their business, values, and industry standing.

- Familiarize yourself with current market trends, economic indicators, and geopolitical events that may impact the company’s operations.

2. Highlight Your Analytical Skills

Signals Analysts are expected to possess strong analytical abilities. Quantify your skills by providing specific examples.

- Emphasize your experience in data analysis, statistical modeling, and econometrics.

- Showcase your ability to identify patterns, draw insights, and make informed decisions based on data.

- Provide examples of successful data analysis projects you have led or contributed to.

3. Present Your Signal Generation Experience

If you have experience in generating trading signals, highlight this skill with confidence.

- Describe your process for developing and validating trading signals.

- Explain the criteria and techniques you use to identify market opportunities.

- Present a case study of a successful trading signal you have generated, emphasizing its impact on portfolio performance.

4. Emphasize Risk Management Expertise

Signals Analysts must be able to assess and manage risk. Showcase your proficiency in this area.

- Highlight your understanding of risk modeling, stress testing, and portfolio optimization.

- Discuss how you incorporate risk management principles into your signal generation and trading strategies.

- Provide examples of situations where you successfully managed risk in a trading or investment context.

5. Prepare for Technical Questions

Be prepared to answer technical questions related to signal analysis. Review the following concepts:

- Statistical modeling techniques (e.g., regression, time series analysis)

- Econometric models (e.g., GARCH, VAR)

- Machine learning algorithms (e.g., supervised and unsupervised learning)

6. Practice Behavioral Questions

Behavioral questions assess your work style, communication skills, and teamwork abilities.

- Prepare anecdotes that demonstrate your problem-solving skills, analytical mindset, and ability to collaborate effectively.

- Practice answering questions related to your motivation, career goals, and why you are interested in the position.

7. Prepare Questions for the Interviewers

Asking thoughtful questions shows your engagement and interest in the role.

- Inquire about the company’s trading strategies and how signal analysis contributes to them.

- Ask about the resources and support provided to Signals Analysts within the organization.

- Seek insights into the company’s growth plans and how signal analysis will play a role in their future success.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Signals Analyst interview with confidence. Remember, a well-crafted resume is your first impression. Take the time to tailor your resume to highlight your relevant skills and experiences. And don’t forget to practice your answers to common interview questions. With a little preparation, you’ll be on your way to landing your dream job. So what are you waiting for? Start building your resume and start applying! Build an amazing resume with ResumeGemini.