Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Vice President and Portfolio Manager position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together

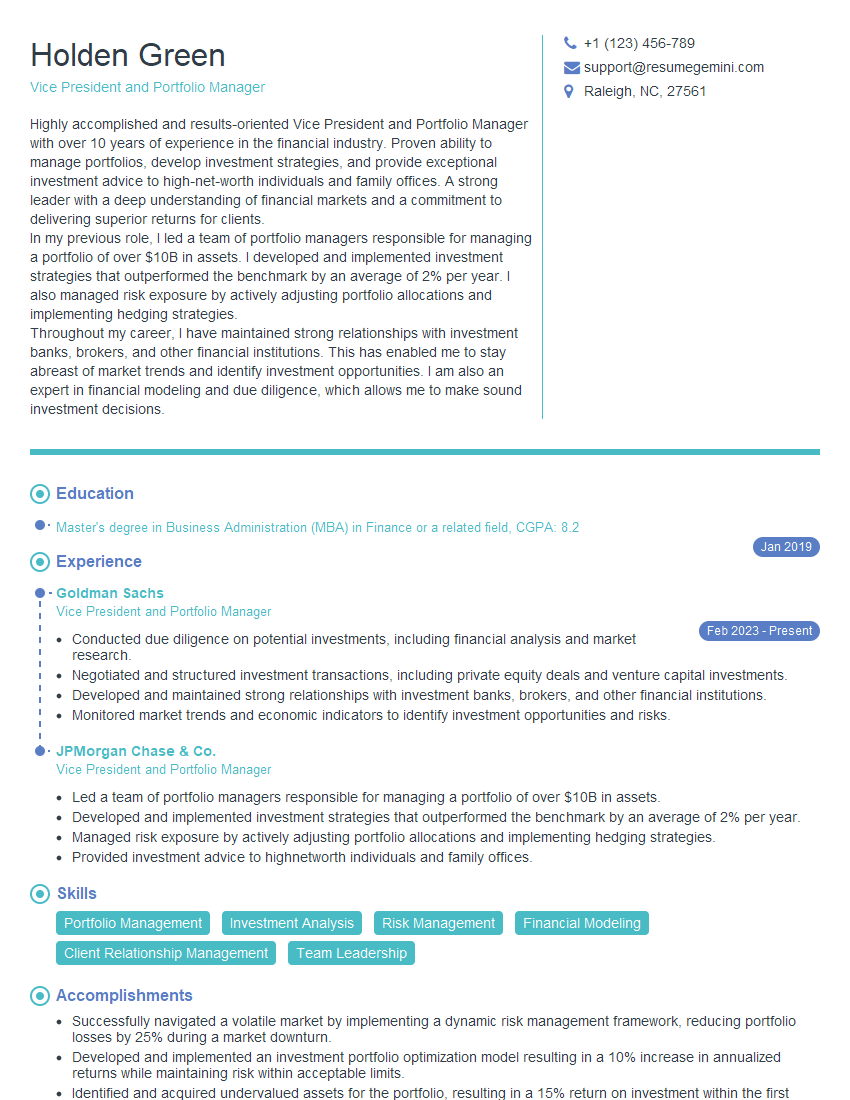

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Vice President and Portfolio Manager

1. How do you determine the appropriate investment strategy for a client?

To determine an appropriate investment strategy for a client, I consider the following factors:

- Risk tolerance: I assess the client’s willingness and ability to withstand potential losses.

- Time horizon: I consider the client’s investment timeframe and the time horizon for their financial goals.

- Investment objectives: I identify the client’s specific financial goals, such as retirement planning, education funding, or wealth preservation.

- Tax considerations: I factor in the client’s tax situation and the potential impact of tax laws on their investments.

2. What are your preferred methods for evaluating investment performance?

Risk-Adjusted Performance Measures

- Sharpe Ratio: Measures excess return over the risk-free rate per unit of risk.

- Sortino Ratio: Similar to Sharpe, but focuses on downside risk.

Absolute Performance Measures

- Total Return: Percentage change in the value of an investment over a period.

- Annualized Return: The average annual rate of return, adjusted for time.

Benchmarking

- Compare the performance of a portfolio to a relevant benchmark, such as a market index.

- Identify areas of outperformance or underperformance.

3. How do you manage risk in a portfolio?

To manage risk in a portfolio, I employ the following strategies:

- Diversification: I spread investments across different asset classes, industries, and geographic regions.

- Asset Allocation: I determine an appropriate mix of stocks, bonds, cash, and other assets based on the client’s risk tolerance and investment objectives.

- Hedging: I use financial instruments, such as options or futures, to mitigate potential losses in certain market scenarios.

- Rebalancing: I periodically adjust the portfolio’s asset allocation to maintain the desired risk-return profile.

4. What factors do you consider when selecting individual investments?

When selecting individual investments, I consider the following factors:

- Fundamental Analysis: I evaluate a company’s financial statements, management team, and industry outlook.

- Technical Analysis: I study price charts and patterns to identify potential trading opportunities.

- Market Trends: I monitor economic and political events to assess the potential impact on investments.

- Investment Thesis: I develop a clear rationale for each investment, outlining the reasons why I believe it will perform well.

5. How do you stay abreast of market trends and developments?

To stay abreast of market trends and developments, I employ the following methods:

- Industry Publications: I regularly read industry magazines, journals, and research reports.

- Market Data: I monitor real-time market data and use analytical tools to identify trends.

- Conferences and Seminars: I attend conferences and workshops to connect with industry experts and learn about emerging trends.

- Networking: I participate in professional organizations and network with other investment professionals.

6. How do you handle challenging market conditions?

In challenging market conditions, I take the following steps:

- Review Portfolio Risk: I assess the portfolio’s risk profile and make adjustments if necessary.

- Monitor Market Data: I closely monitor market data to identify potential opportunities and risks.

- Communicate with Clients: I provide timely updates to clients and address their concerns.

- Stay Calm and Rational: I maintain a calm and rational demeanor while making investment decisions.

7. What is your process for monitoring and reporting portfolio performance?

I follow a structured process for monitoring and reporting portfolio performance:

- Regular Reviews: I conduct periodic reviews to assess portfolio performance against benchmarks and client objectives.

- Performance Metrics: I track key performance metrics, such as return, risk, and portfolio composition.

- Client Reports: I provide detailed reports to clients that summarize portfolio performance, investment strategy, and market outlook.

- Performance Attribution: I analyze the sources of portfolio performance to identify the factors contributing to success or underperformance.

8. How do you build and maintain relationships with clients?

I build and maintain relationships with clients through the following practices:

- Active Communication: I maintain regular contact with clients to update them on portfolio performance and address their concerns.

- Transparency and Trust: I provide transparent communication and strive to earn the trust of my clients.

- Personalized Service: I tailor investment strategies and communication to meet the unique needs of each client.

- Education and Empowerment: I educate clients on investment concepts and empower them to make informed decisions.

9. What is your investment philosophy?

My investment philosophy is based on the following principles:

- Long-Term Focus: I believe in investing for the long term, focusing on the potential for sustainable growth.

- Diversification: I advocate for spreading investments across different asset classes and sectors to mitigate risk.

- Value Investing: I seek investments that are trading at a discount to their intrinsic value.

- Continuous Learning: I believe in constantly updating my knowledge and skills to stay ahead of market trends.

10. How do you stay informed about regulatory changes and their potential impact on investment strategies?

To stay informed about regulatory changes and their potential impact on investment strategies, I employ the following methods:

- Regulatory Monitoring: I regularly monitor regulatory websites and publications to stay abreast of new regulations and amendments.

- Industry Associations: I participate in industry associations that provide updates and guidance on regulatory changes.

- Legal Counsel: I consult with legal counsel to interpret regulatory changes and assess their implications for investment strategies.

- Continuing Education: I attend seminars and workshops to stay informed about the latest regulatory developments.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Vice President and Portfolio Manager.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Vice President and Portfolio Manager‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Vice President and Portfolio Managers are responsible for directing and managing investment portfolios, including asset allocation, security selection, and risk management. They collaborate with other investment professionals and financial advisors to achieve investment objectives. Key job responsibilities include:

1. Portfolio Management

Develop and execute investment strategies based on client objectives, market conditions, and risk tolerance.

- Conduct fundamental and technical analysis to identify potential investments.

- Monitor portfolio performance and make adjustments as necessary.

2. Asset Allocation

Determine the appropriate mix of asset classes (e.g., stocks, bonds, real estate) for each portfolio.

- Consider factors such as risk tolerance, investment horizon, and return expectations.

- Monitor the market and adjust asset allocation to optimize returns.

3. Security Selection

Identify and recommend specific securities for inclusion in portfolios.

- Research companies and analyze financial statements.

- Evaluate investment opportunities and make recommendations based on expected returns and risks.

4. Risk Management

Identify and mitigate potential risks to investments.

- Implement risk management strategies such as diversification and hedging.

- Monitor market trends and potential threats to investments.

Interview Tips

To ace the interview for the position of Vice President and Portfolio Manager, it is essential to prepare effectively. Here are some tips:

1. Research the Company and Position

Thoroughly research the investment firm and the specific role you are applying for.

- Understand the firm’s investment philosophy, strategies, and track record.

- Learn about the key responsibilities and expectations of the position.

2. Practice Your Answers

Prepare thoughtful and concise answers to common interview questions related to portfolio management, financial analysis, and risk assessment.

- Use examples from your previous experience to demonstrate your skills and knowledge.

- Be prepared to discuss your investment philosophy and how it aligns with the firm’s strategy.

3. Demonstrate Your Analytical and Problem-Solving Abilities

Highlight your ability to analyze financial data, identify investment opportunities, and solve problems.

- Use case studies or real-world examples to showcase your analytical thinking.

- Explain how you approach risk management and make investment decisions under uncertainty.

4. Emphasize Your Communication and Presentation Skills

Vice Presidents and Portfolio Managers must effectively communicate with clients, colleagues, and other stakeholders.

- Prepare a presentation on a recent investment opportunity or market trend.

- Demonstrate your ability to clearly explain complex financial concepts to non-financial professionals.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Vice President and Portfolio Manager interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!